Form 1099 int for interest income is used to report interest payments made in the course of your trade or business. The 1099 int summarizes income of more than $10 from interest along with associated expenses. This form must be provided to the recipient and a copy mailed to, or I filed with the IRS. The due date for paper filing form 1099 int is February 28th 2014. If you choose to e-file the due date is automatically extended to March 31st 2014. Please keep in mind that recipients must be provided a copy by January 31st. The form 1099 int must be filed for each person to whom you paid interest amounts of at least $10 or $600 of interest paid in the course of your trade or business. You must file this for each person for whom you withheld and paid any foreign tax on interest or from whom you withheld and did not refund any federal income tax under the backup withholding rules, regardless of the amount of the payment. The IRS encourages filing for this information return and mandates that anyone file 250 or more must file these returns electronically. You can go to express tax filings com and find an IRS authorize defile provider if you have any questions. You can contact our support team from our headquarters in Rock Hill, South Carolina at seven zero four eight three nine two seven zero or email us at support@express-tax- filings.

PDF editing your way

Complete or edit your 2021 1099 does anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 2020 int field directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your interest form 2021 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 2021 form interest by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form 1099 Int

About Form 1099 Int

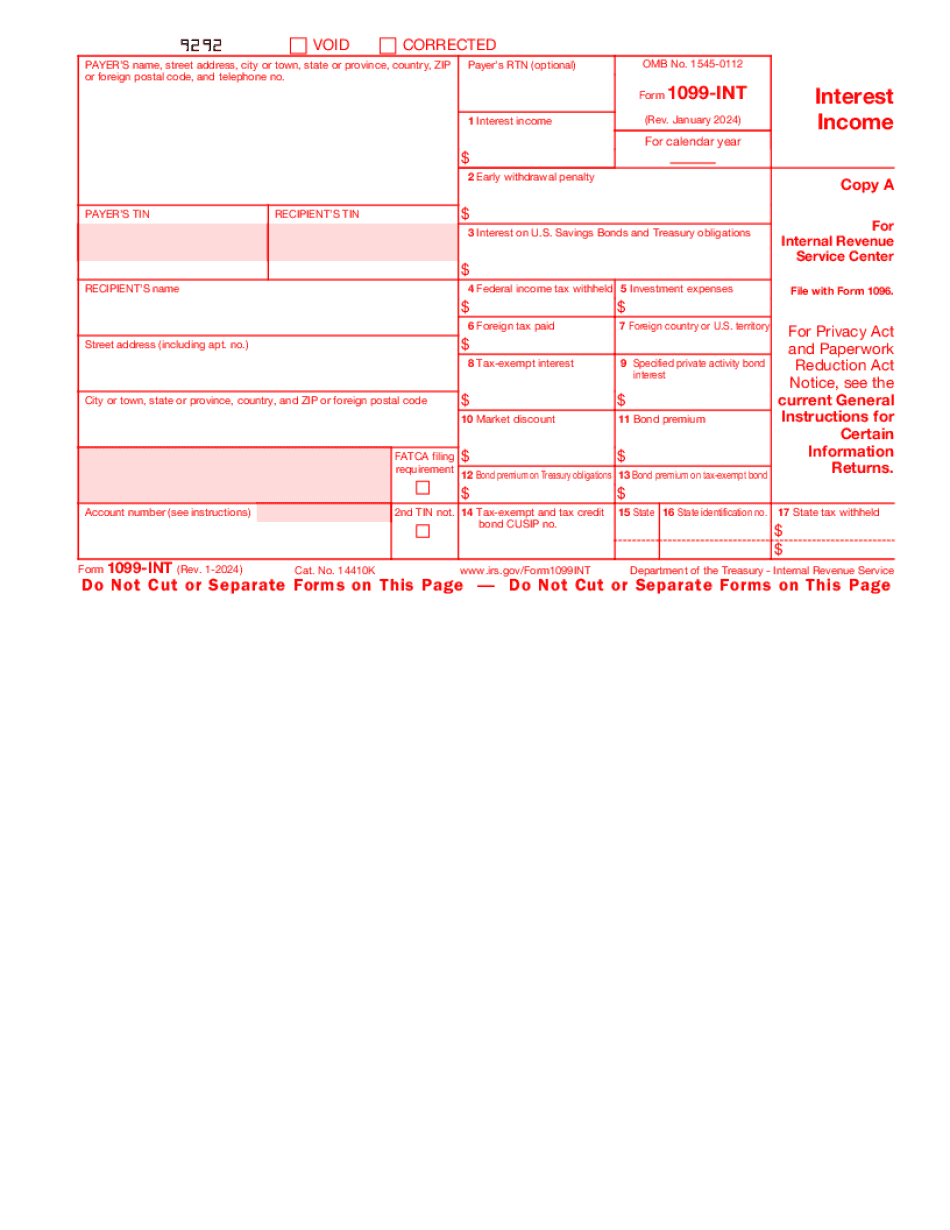

Form 1099-INT is a tax form used to report interest income. It is issued by banks, brokerages, and other financial institutions to people who earned more than $10 in interest during the tax year. This form reports the amount of interest paid to the individual as well as any federal tax withheld. The recipient of this form needs it to report their interest income on their federal income tax return. It is also sent to the IRS for tax purposes.

What Is 1099 Int?

Each financial institution, that pays you more than $10 of interest during the year has to send you a form 1099-INT. You don’t need to attach it to your taxes, but you should use the information from it on your tax return. Basically, your bank has to send you this document by January 31 and file it with the Internal Revenue Service. Whether you are a payer or an investor, IRS wants to ensure that you report the correct amount of interest income on your tax return.

Form 1099-INT includes all types of interest income earned during a year and all related expenses. There are few exemptions. For instance, it is not necessary for you to file 1099-INT in case you made payments to such payees as corporations, tax-exempt organizations or any individual retirement arrangement (IRA).

The payer must include only interest payments made in the course of your trade or business.

To facilitate the process of preparing the 1099-INT use a fillable template, that is available online. The template consists of 17 editable boxes, which should be filled out with the required information. Include the following:

- payer's and recipient’s personal information (name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no.);

- payer’s and recipient’s TIN;

- account number;

- all amounts of interest income paid and withhold.

Print the completed document to keep it for your records.

Online choices make it easier to organize your document administration and enhance the productiveness of one's workflow. Stick to the short guide for you to full Form 1099 Int, stay away from mistakes and furnish it in a timely way:

How to finish a 1099?

- On the web site using the form, click on Start off Now and move to the editor.

- Use the clues to fill out the pertinent fields.

- Include your personal details and speak to facts.

- Make convinced you enter right details and quantities in suitable fields.

- Carefully examine the subject matter with the variety also as grammar and spelling.

- Refer that will help portion when you've got any thoughts or deal with our Guidance staff.

- Put an electronic signature on the Form 1099 Int aided by the support of Signal Resource.

- Once the shape is finished, press Executed.

- Distribute the all set kind through e-mail or fax, print it out or help save on the equipment.

PDF editor will allow you to definitely make improvements with your Form 1099 Int from any online world related unit, customize it according to your requirements, indication it electronically and distribute in various means.

What people say about us

Suggestions to go paperless at home

Video instructions and help with filling out and completing Form 1099 Int