So, welcome. Thank you for deciding to go ahead and join this course. What we're gonna be covering in this part one is an overview of what 1099 reporting is and a little bit about the purpose of all these 1099s. We'll also talk about when to file the 1099 forms, how to file them, and where to file the forms. We'll cover who gets the 1099 and some exceptions as to who shouldn't get it. That's gonna be our purpose and goal for today. As we look at the overview for 1099 reporting itself, we have to know that it is commonly misunderstood. There is a lot of misunderstanding of the requirements related to 1099 forms, especially as it relates to independent contractors, which is the most common type of 1099. Over the past several years, there have been a lot of new requirements and legislation put in effect and removed, which adds to the confusion. Unfortunately, the requirements are always changing. In the 1099 course we've developed, we have three parts. Part one covers a lot of the rules and requirements, like we're doing right now. Part two will cover all the specific forms and their instructions and rules. Part three will talk about compliance penalties and additional reporting. This is a comprehensive guidebook for 1099 reporting. You can find the course manual at taxedge365.com/canopy. If you have any troubles, try using lowercase letters. As we look at the reporting requirements, the IRS has implemented a variety of these requirements for anyone engaged in a trade or business. The requirements are contained in the Internal Revenue Code section 6042 through 6050. They generally require information returns to be made by every person engaged in a trade or business.

Award-winning PDF software

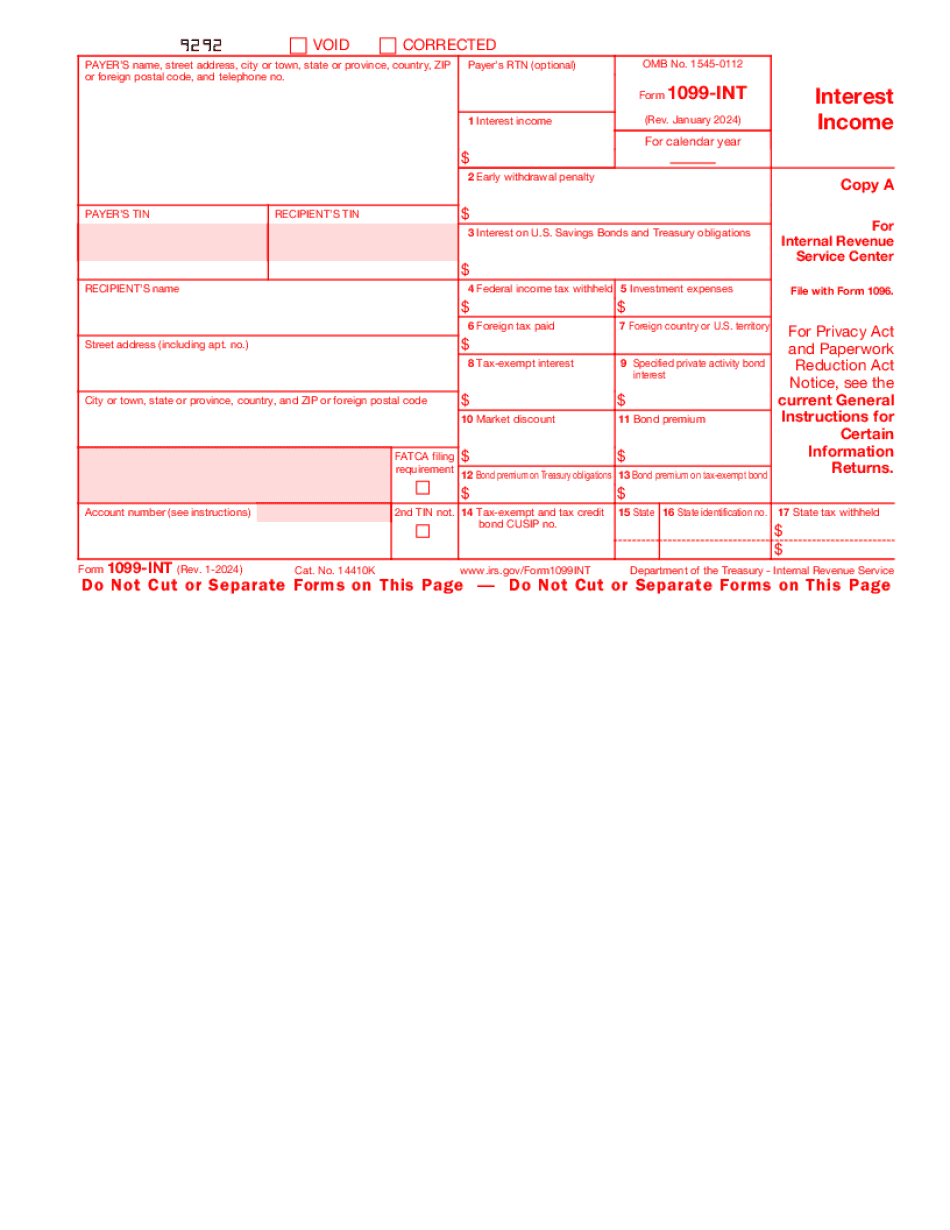

1099-int instructions Form: What You Should Know

Interest Paid, Earnings Reportable, Form 1099-INT, Interest Income, Withholding Amount. IRS Forms 1099-INT Interest income tax form. These forms were filed by more than 400,000 taxpayers in FY 2017. IRS Forms 1099-INT: Income from sources other than wages or interest reportable in box 1 or 8 of this Form 1099-INT interest income form: Interest Direct Taxation and Form 1099 IRS Form 1099-T — Wages and Deductions: Dec 20, 2025 — Every payer of earnings and wages on wages, salaries, commissions and other forms of gain or profit must file a statement of the amount the recipient of those wages and payments expects to be paid in a calendar quarter as of the end of such calendar period.” The IRS asks whether any portion of any dividend or interest payment is not includible in gross income. Forms W-4 — Unemployment Insurance Direct Taxation and Form 1099-T IRS Forms 1099-T — Wages and Deductions: Direct Taxation and Form 1099-T IRS Form 1099-SE — Wages and Deductions: Direct Taxation and Form W-4 — Unemployment Insurance Direct Taxation and Form 1099-SE — Wages and Deductions: Direct Taxation and Form W9/ETC: Taxes on Employment-Based Plans Direct Taxation and Form W9/ETC: Taxes on Employment-Based Plans Direct Taxation and Form 1099-K — Filing Instructions for a Foreign Personal International Entity Filing of Forms W-2 Dec 6, 2025 — The Internal Revenue Service (IRS) will collect a 1099-K from the employer for the employee if the employer makes a W-2 for the employee that contains the appropriate information.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099 Int, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099 Int online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099 Int by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099 Int from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1099-int instructions