Divide this text into sentences and correct mistakes: - You got income from your bank. Where do you report that in your TurboTax? As we're going to talk about here today, so don't forget to subscribe down below, thumbs up, comment. The whole thing helps a lot, so let's dive right into this. This is a pretty easy one, actually. Sorry, go back to TurboTax. Again, I'm using the TurboTax Live Deluxe as my premise here and we're gonna go over to federal to calm on the left-hand side or go to federal. Basically, what we're going to do is anything that's income related will show on the top left as the wages and income tab. You want to click on that. So what we're going to do is we're gonna scroll down here. It's not wages and salaries, so it's not W-2. It's not self-employment. It's not an appointment. It's not other common income. It is 1099 int for interest. That is what it is. And this is actually quite easy. We're gonna go down here and we're gonna hit interest on 1099 int. And we're going to click on that guy and we're just gonna go and type this stuff in. It's literally that. So, you got a 1099 from. We're gonna say Navy Federal Credit Union at this point. And we're going to type in Navy Federal Credit Union as where it's received run from. We're gonna say how much interest income is it. We put 800 bucks. We gotta make sure it's an interest that belongs to in this case, joint from my wife and me. And then we're gonna hit continue. And literally, it's the. They did not provide a federal employer identification number, so we're just gonna say no and. And none of these, we...

Award-winning PDF software

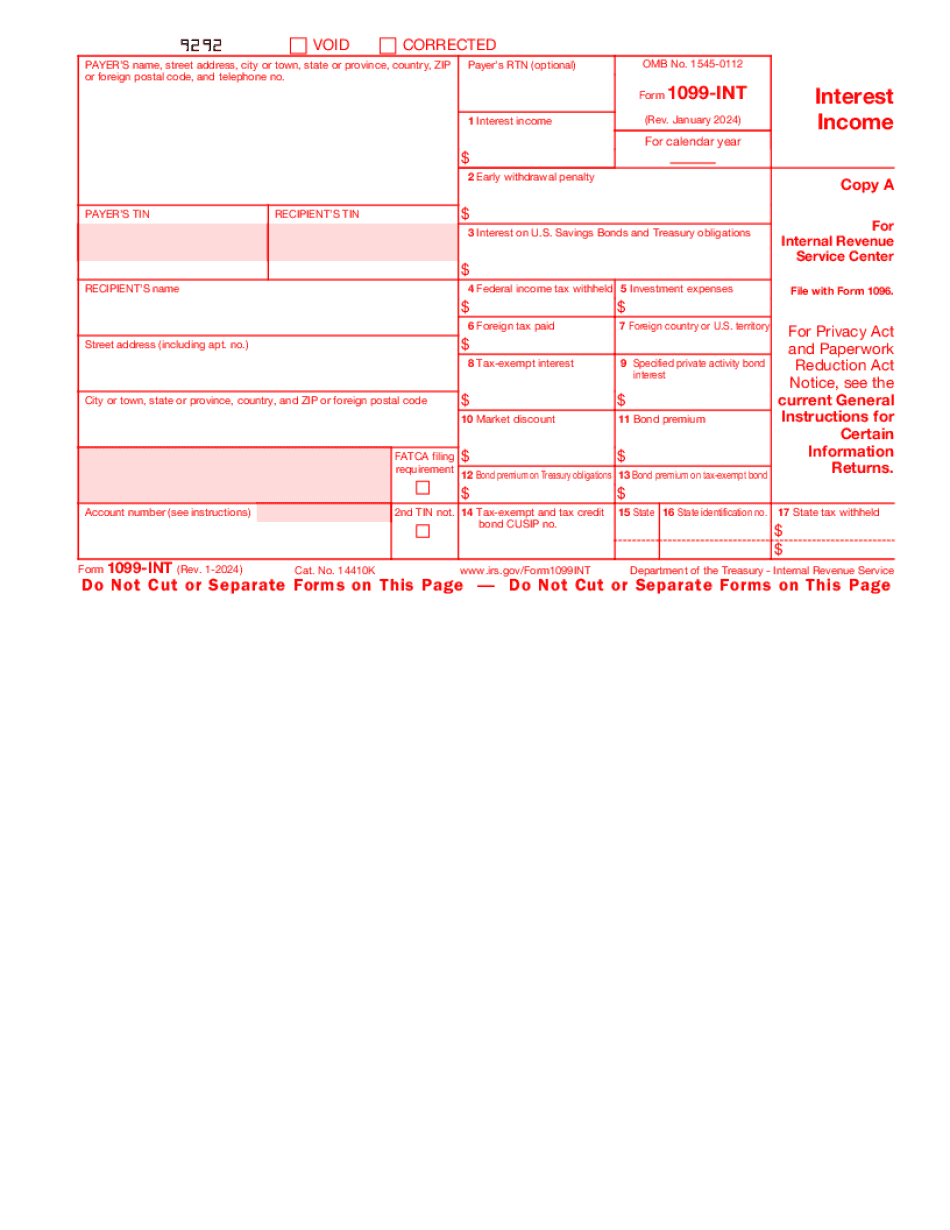

2018 1099-int Form: What You Should Know

Forms 1099G and 1099INT do not normally include interest.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099 Int, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099 Int online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099 Int by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099 Int from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 form 1099-int