Award-winning PDF software

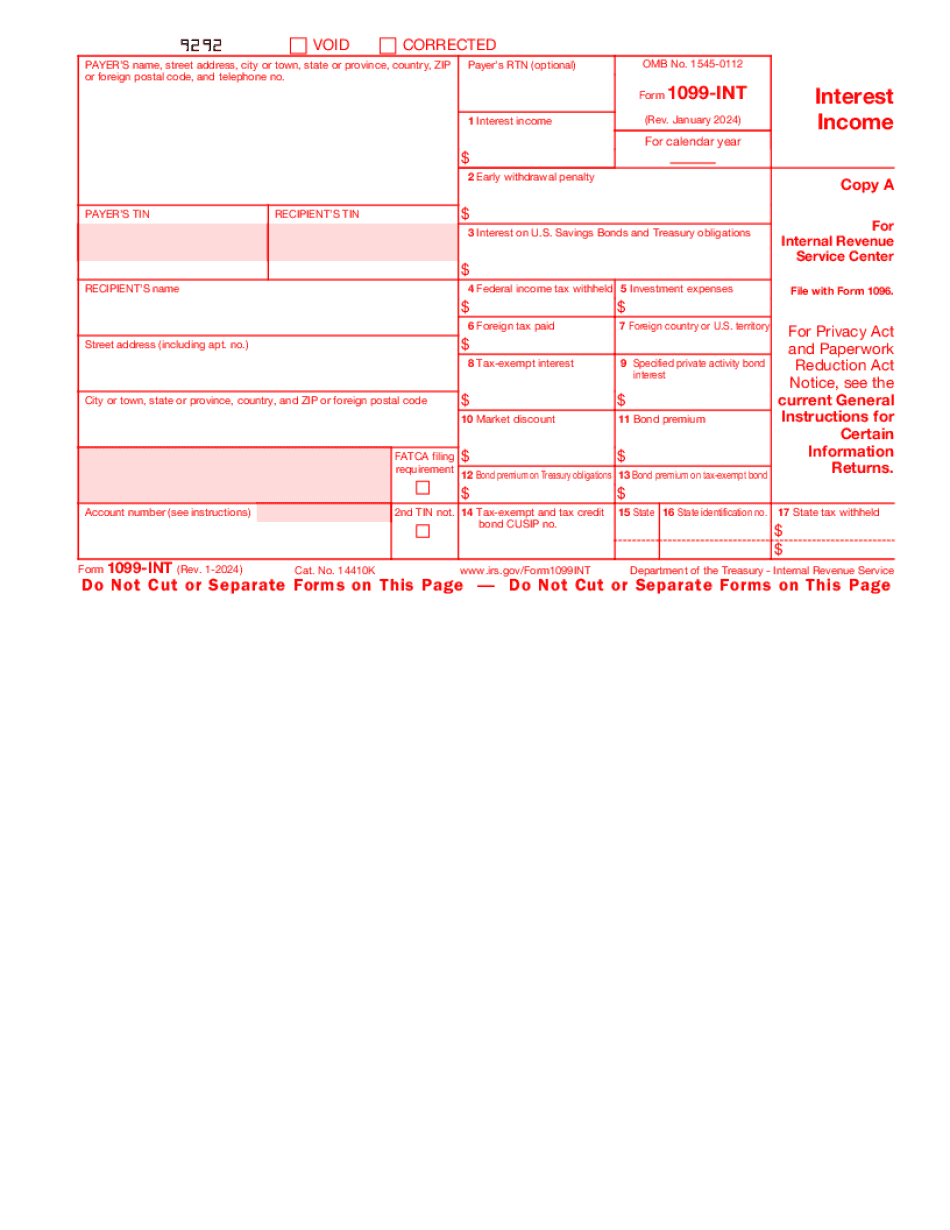

Wichita Kansas Form 1099 Int: What You Should Know

KS 67202 Dividend from a business or a personal income that a nonprofit corporation receives. This is an income tax instrument to report on the Form 1099-DIV. This information is useful for determining income tax reporting requirements by filing Form 1099-DIV. Form 1099-DIV (dividends), including those from stocks or mutual Fund distributions. This is an income tax instrument to report on the Form 1099-DIV. This information is useful for determining income tax reporting requirements by filing Form 1099-DIV. Form 1099-DIV (interest earned or paid), including those from mutual Fund and stocks as defined by the IRS. This is an income tax instrument to report on the Form 1099-DIV. This information is useful for determining income tax reporting requirements by filing Form 1099-DIV. Notice of Federal Tax Lien on real property or personal property. If you own real property or personal property you will want this form because it will provide the information to you needed to prepare and file a federal tax lien. Citizens United v. FEC A few years later, in 2010, the Supreme Court ruled in Citizens United v. FEC, which is sometimes known as “Citizens United vs. the FCC.” The ruling held that restrictions on political contributions are unconstitutional. Because of this decision, the government can no longer shut off access to certain donors and political action committees (PACs) that are not considered political committees. This resulted in corporations and unions being allowed to participate on equal footing with other political action committees (PACs) on a national level. If you need money right now! Donations to the Clinton campaign, from individuals, PACs, or corporations are considered political contributions, as they are made to help elect the Democratic candidate and not to support a PAC or for other purposes. Some financial institutions are also not allowed to accept donations from corporations and the like.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Wichita Kansas Form 1099 Int, keep away from glitches and furnish it inside a timely method:

How to complete a Wichita Kansas Form 1099 Int?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Wichita Kansas Form 1099 Int aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Wichita Kansas Form 1099 Int from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.