Award-winning PDF software

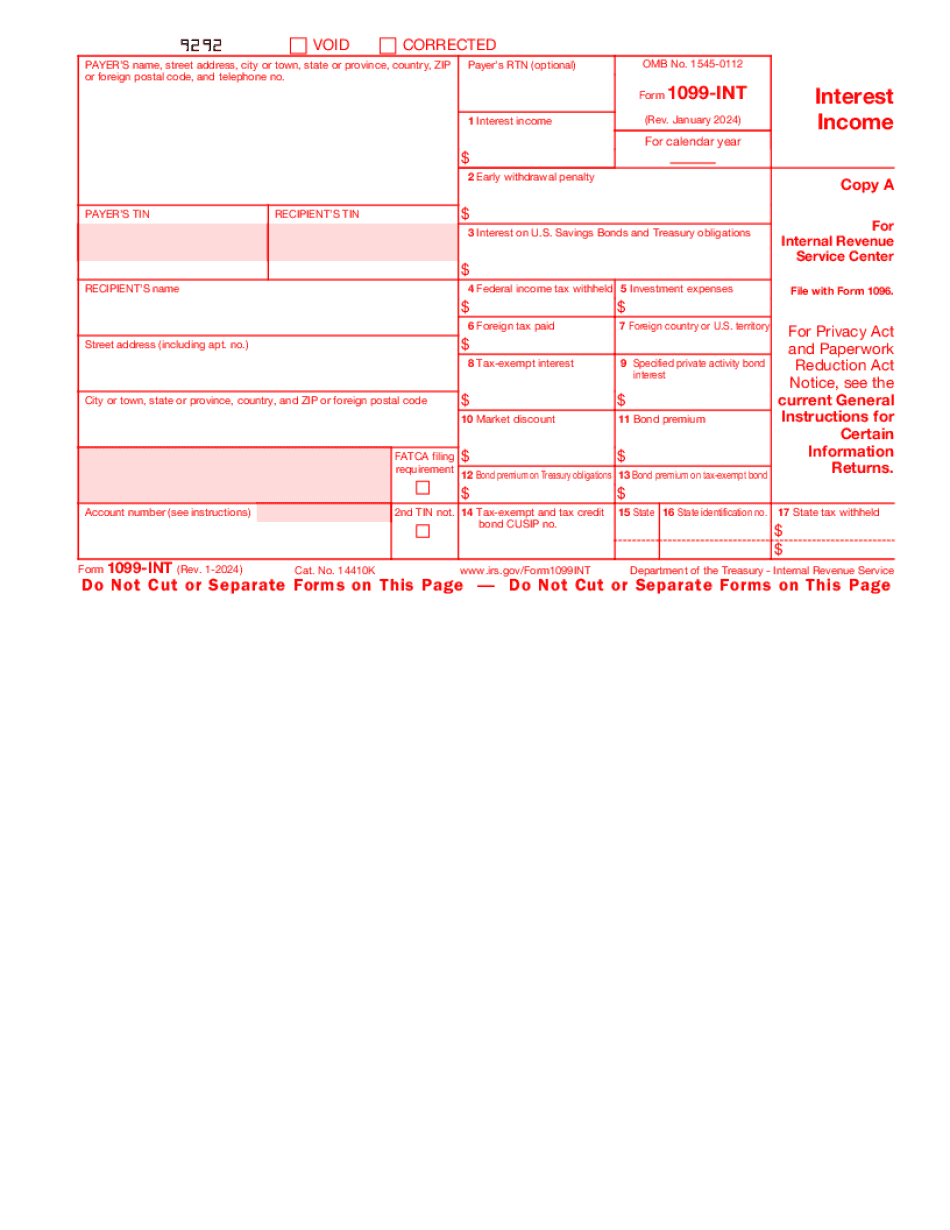

Nampa Idaho Form 1099 Int: What You Should Know

The first two pages can be used to make filing a lot easier. Here's the entire page. Here are some resources to help you get started. They all assume you are a small business owner selling directly to the consumer. The IRS is aware of tax-exempt organizations that are conducting small business tax-exempt conversions. We encourage you to read IRS Bulletin 2003-15. Idaho's income tax form requires a return to be filed on or before the due date if noncompliant. Use Form 965 to make a reasonable estimate of gross sales for taxable income from January 1 – July 15. Include all income received. All expenses must be estimated as well. Use Form 940 or Form 941 to report all sales and deductions. This information is required for nonbusiness related income. CATEGORY 5. NONPROFIT REVENUE “Nonprofit corporation” is not the same as “Social Club.” Both refer to tax status. Social clubs need to obtain a 501(c)(3) exemption certificate from the IRS. Forms are available for you to download here. Form 1091-C/A — Miscellaneous Income A nonbusiness entity is only entitled to a 1091-C form if it does not “actively solicit” the sale or exchange of goods or services. “Active solicit” is defined as: 1) having an individual participating in its efforts to sell or otherwise dispose of the goods or services or 2) making a solicitation of a person to sell or otherwise dispose of the goods or services on an annual or other regularly recurring basis, without distinction, of whether sales made during the solicitation are made to or from the individual or to or from any other person. Form 1099-K — Miscellaneous Income Report This filing requires the entity to provide the seller with correct address information at the time of making a sale. The seller need not be a taxpayer. You have a lot of options for doing your federal tax returns (for the first time). Online — The IRS.gov. All the forms and instructions are free. Paper — Not available at this time. Contact your state or local tax enforcement authorities. I have spent years helping taxpayers make their filings and understand their options. We know we can't tell you what it will take to file your taxes.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Nampa Idaho Form 1099 Int, keep away from glitches and furnish it inside a timely method:

How to complete a Nampa Idaho Form 1099 Int?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Nampa Idaho Form 1099 Int aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Nampa Idaho Form 1099 Int from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.