Award-winning PDF software

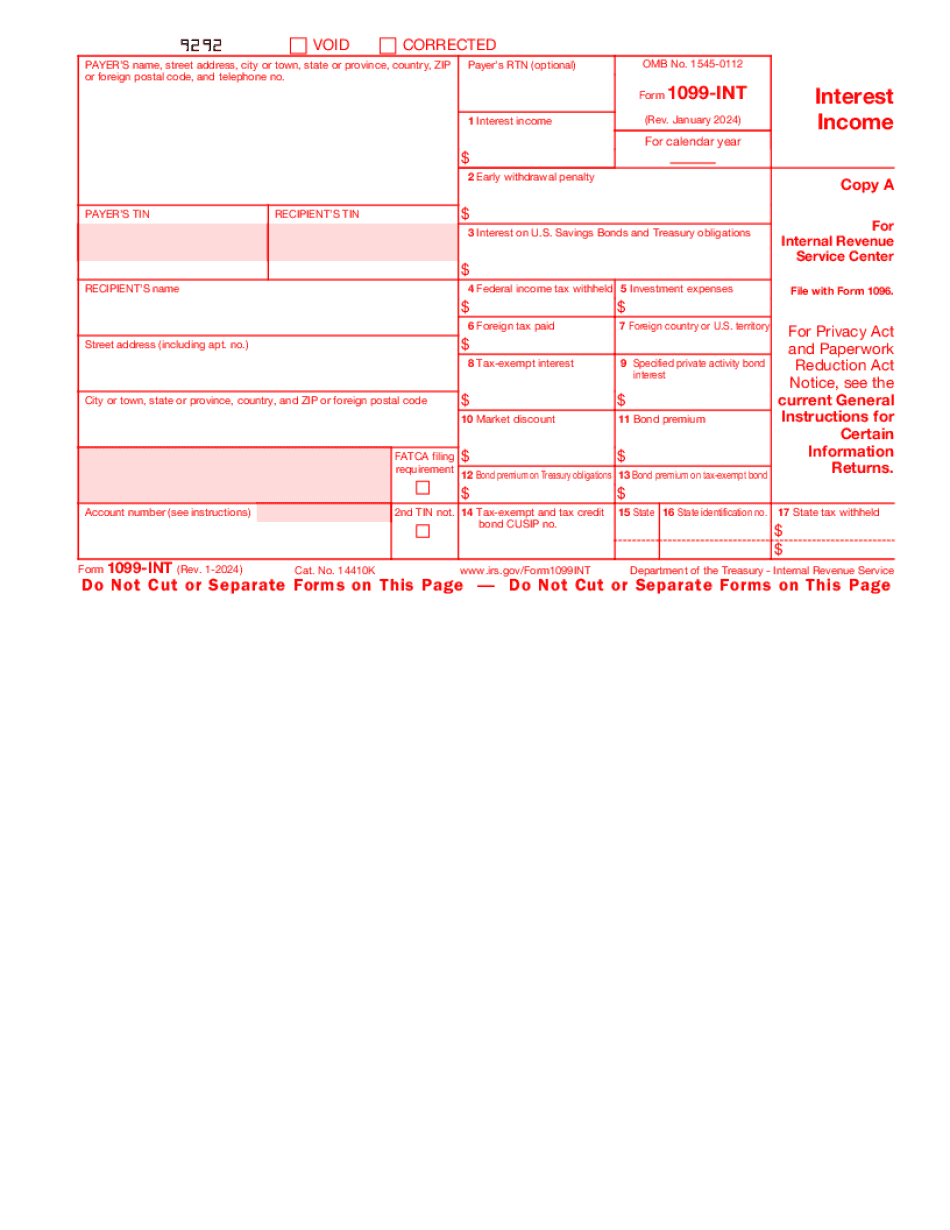

Printable Form 1099 Int Westminster Colorado: What You Should Know

Form W-2 is not acceptable for any return, and most business form filers just want to send 1099s to the IRS instead of paying their taxes. 1099s are not tax forms, and are not required by the IRS. They are used for non-tax transactions such as taxes or investments. For more details on 1099s, please visit IRS.gov. For a complete guide on what 1099s are all about see the IRS article in this series: The IRS is now using 1099s to collect the wages of non-citizens who are the sole owner of a limited liability company which they may own only in their U.S. and Colorado domiciled state. I have been filing 1099s for two years for myself/others, but I still wonder if they are even allowed. I believe the answer may depend upon whether the non-citizen was born in the USA or had a foreign parent. A person is the legal owner of their property whether born in the USA or a foreign country. The IRS has indicated that you may, under certain circumstances, receive W-2s and 1099s without the need to include a foreign parent. The IRS has further indicated that you are not required to include a foreign parent if the sole owner is a person who is not a U.S. citizen. In some cases, the IRS may decide that you are already the sole owner of the business, and thus no need to list the foreign parent, and the foreign parent does not need to be included in your income. If the sole owner/s are a U.S. citizen, then a resident alien and/or U.S. expatriate, they are also exempt from the requirement to include a foreign parent. The foreign parent will be used to report income to a foreign country, where its source does not substantially affect its current U.S. source income. If the sole owner is a non-U.S. citizen, then they are required to list their foreign parent as part of their 1099. A “foreign parent” is someone who either is a U.S. citizen, is a resident alien or is a non-U.S. expatriate. This situation makes it possible to file an additional form, a Schedule E, which will show the business income and expenses without listing the foreign parent (unless the sole owner is a U.S. citizen).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1099 Int Westminster Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1099 Int Westminster Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1099 Int Westminster Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1099 Int Westminster Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.