Award-winning PDF software

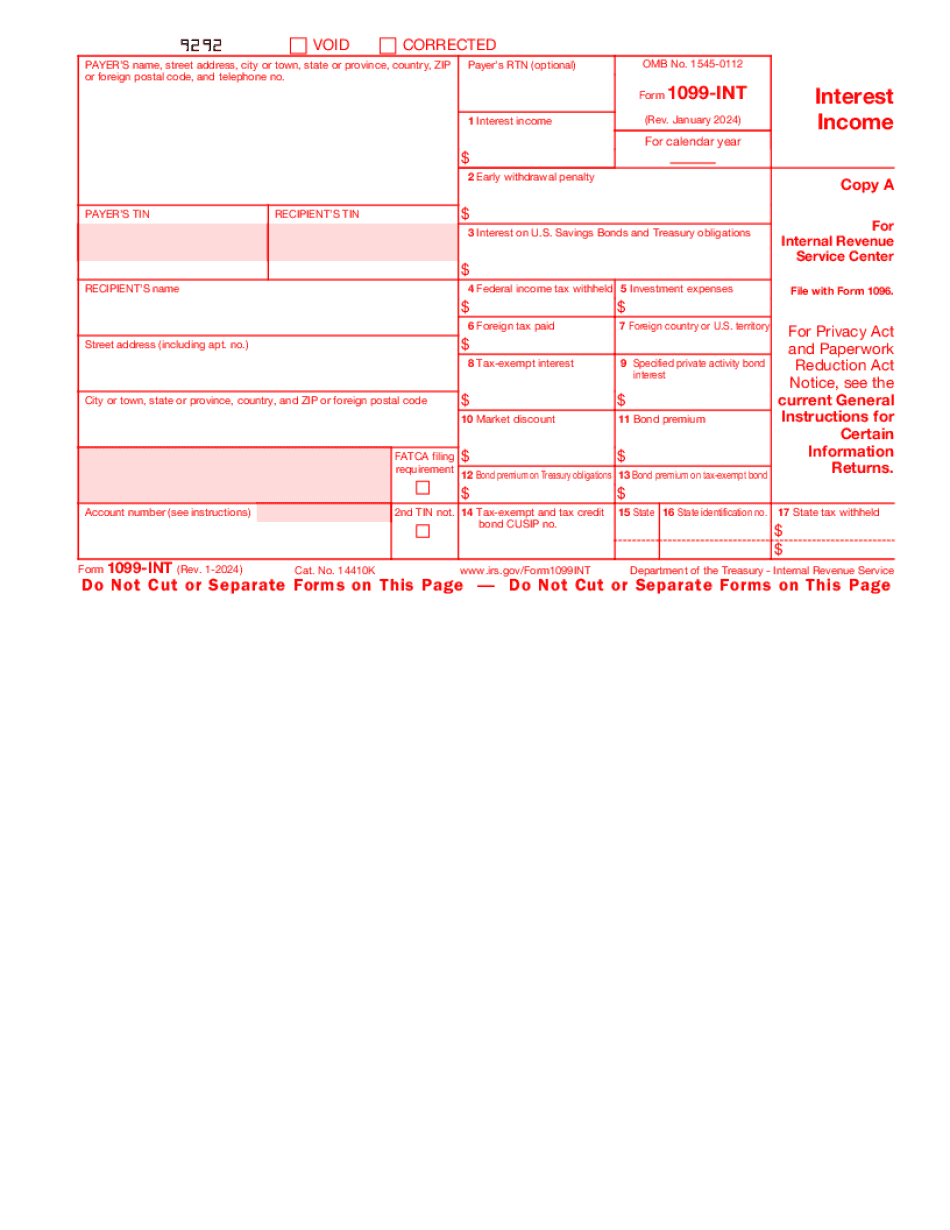

Printable Form 1099 Int Sunnyvale California: What You Should Know

Download a 1099 Online Trial here or go to track1099.com to learn more about our free 1099 software. About the Payroll Deductions FAQ About the Tax Topic Fact sheet Tax Topic Fact sheet #13: Wage and Tax Equivalents — Revenue Procedure 2014-31 Tax Topic Fact sheet #14: Employer's EXIT Deduction — Revenue Procedure 2014-31 Tax Topic Fact sheet #15: Credit for Educational Assistance Received by Foreign Kids (including the Foreign Relocation Exception) — Fiscal Year 2015 1. IRS Publication 526, Tax Guide for Small Business, provides guidance about itemized deductions and credits subject to various limitations. 2. On page 6, it states: (A) The cost of a meal when ordered or delivered at the business' establishment. (B) The cost of a lunch or dinner when eaten as part of a business meal program. The expenses you incur for meeting the medical, dental or vision needs, or the education and training of children of yours. (D) The depreciation that would result if you sold any of your assets (real property) and used the proceeds to purchase, for your business, a new dwelling that is not a single-family residence. 3. On page 6, it states: (A) The cost of a meal when ordered or delivered at the business' establishment. (B) The cost of a lunch/dinner when eaten as part of a business meal program. The expenses you incur for meeting the medical, dental or vision needs, or the education and training of children of yours. (D) The depreciation that would result if you sold any of your assets (real estate) and used the proceeds to purchase, for your business, a new dwelling that is not a single-family residence. 4. On page 5, it states: Itemized deductions do not include any costs paid on the following: (A) Food, beverages, lodging, or entertainment. (B) Gifts or services of a personal nature, including mortgage interest. Medical expenses incurred by a former spouse, civil union or domestic partner, or dependent children. 8 U.S. Code 1202 (relating to exclusions of gross income from sources within and without the United States).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1099 Int Sunnyvale California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1099 Int Sunnyvale California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1099 Int Sunnyvale California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1099 Int Sunnyvale California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.