Award-winning PDF software

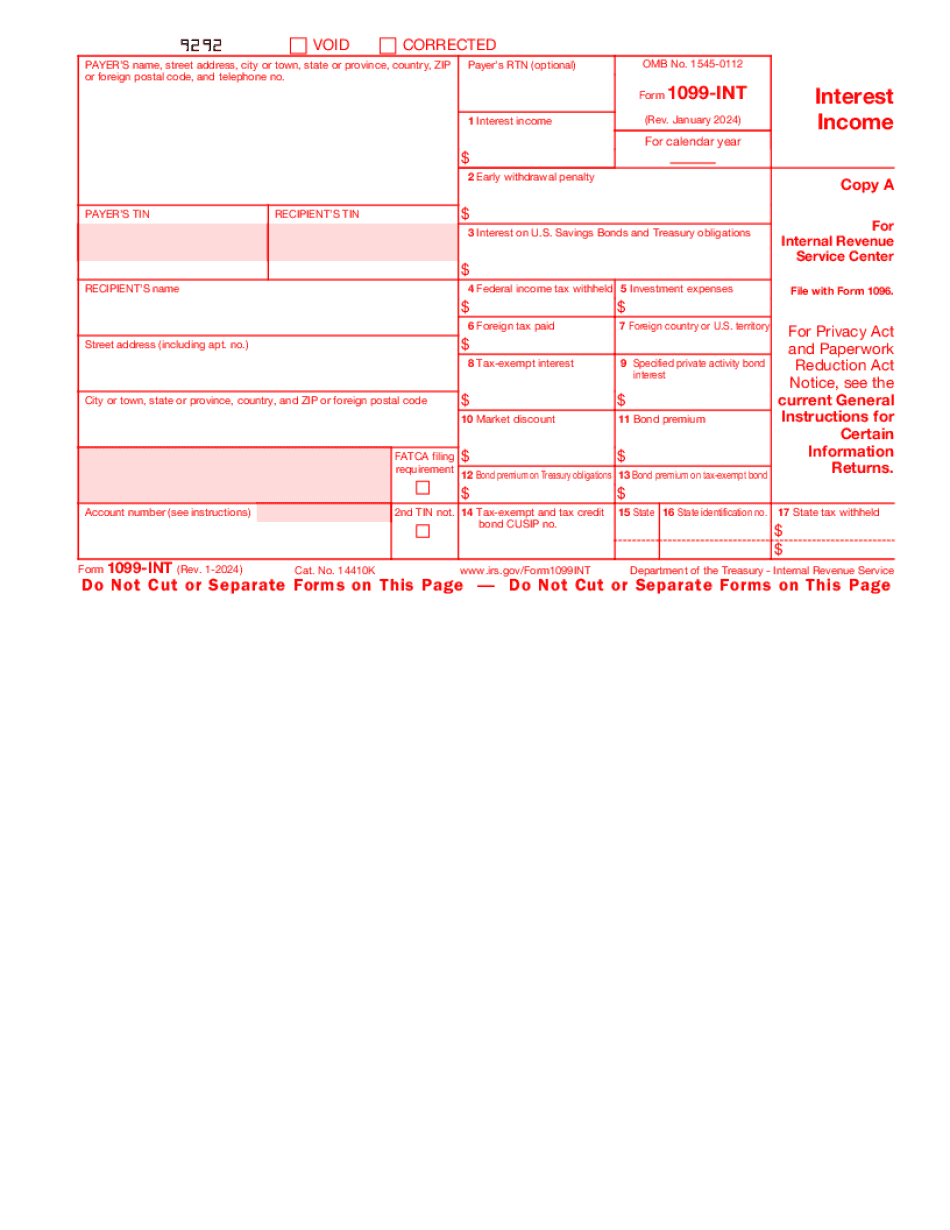

Form 1099 Int online Glendale Arizona: What You Should Know

Sales Tax does not include the sale of ammunition, ammunition magazines, or the use of silencers on firearms. Annual Sales tax does not include the use of the following when purchasing ammunition: “Carry a handgun on your hip, belt, in shoulder holster, or on a belt holster; a concealed handgun permit or a permit authorizing the storage of a handgun in a vehicle by a law enforcement officer, peace officer or court officer, except in accordance with the Arizona state constitution; or a permit authorizing the storage of a firearm or bow and arrow in a vehicle by a person with a disability;, or that exempts the proper use of a firearm in a private residence or in a place where other individuals would have a reasonable expectation of privacy, except pursuant to a valid federal firearms license issued by the Federal Bureau of Alcohol, Tobacco and Firearms.” (A.R.S. §13-3510) The following rules, guidelines and instructions are the same for the annual and non-annual renewal sales tax, which do not apply to purchases, or sales, of ammunition, or silencers. A. The use of ammunition by handgun owners is exempt from sale tax if the ammunition is purchased for the personal use of the gun owner, or as a gift of a handgun to a child, a law enforcement officer or court officer, or a disabled police officer. B. This exemption does not apply to ammunition the handgun owner purchases for the use of a person or a place of business that is not the firearm owner's residence, business or place of business, or as a gift of a handgun to a child, a law enforcement officer or court officer. C. The use of ammunition by handgun permit holders and holders of a federal exemption from the licensing, use and registration requirements of federal law shall not be subject to sales tax. The only exception to this rule is the sale of shotgun shells. Shotgun shells are not exempt from this rule, but shall be separately taxed. The sale of “silencers” as defined in A.R.S. §13-3204 shall not be subject to the rule. A sales tax exemption applies to firearms, ammunition, and accessories used as a prop or in an exhibition, display or other public activity that has as its primary purpose to promote crime, violence against an individual or family, or drugs.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099 Int online Glendale Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099 Int online Glendale Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099 Int online Glendale Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099 Int online Glendale Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.