Award-winning PDF software

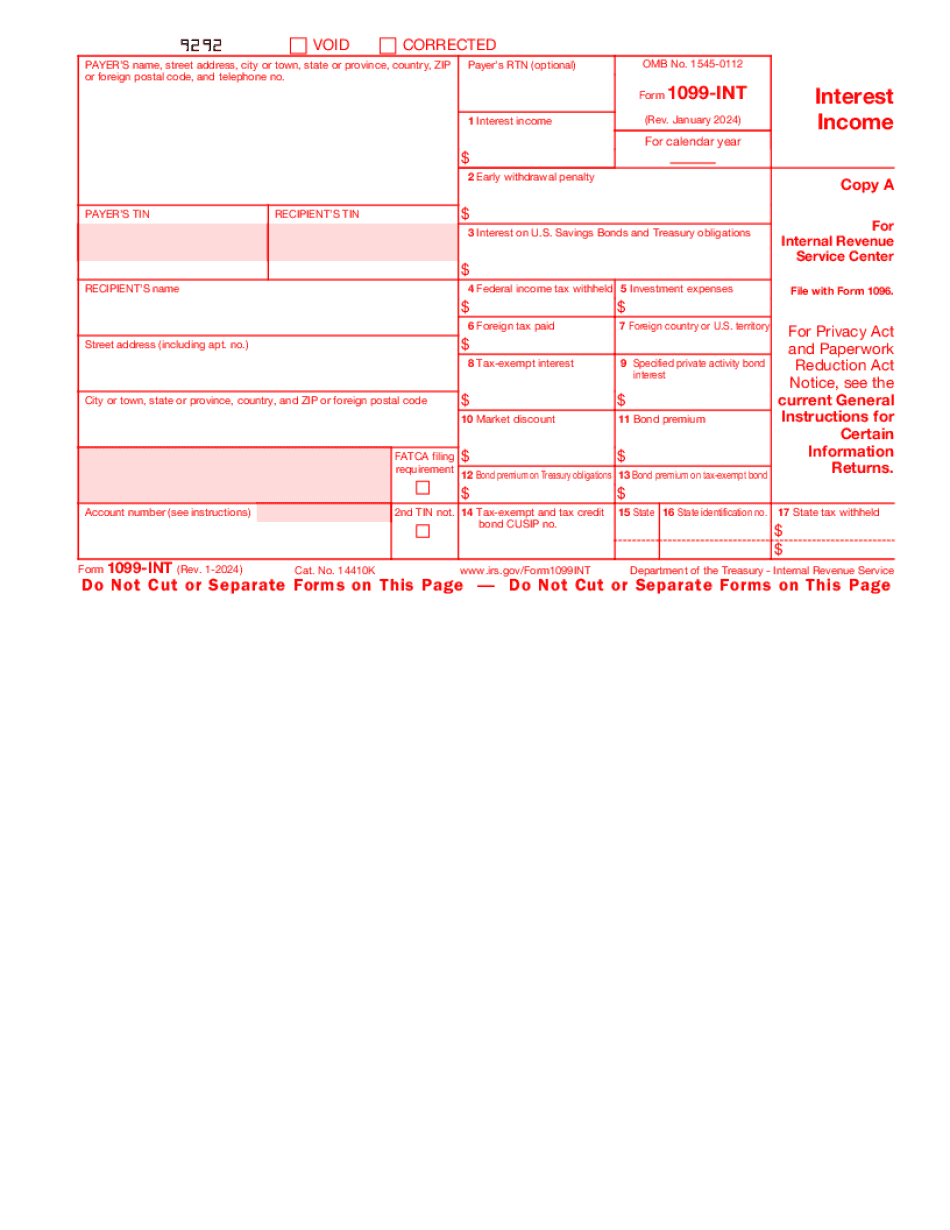

Printable Form 1099 Int San Diego California: What You Should Know

Tutorial explains the meaning of and how to use the various lines of this form. You will be asked to complete these lines as you submit your 1099-MISC form. 2. The lines of Form 1099: The first 10 lines of every 1099-MISC are used as follows: Line 1 is a line to report any item that will be included in your 1099-MISC due to the nature of your employment — including, for example, unemployment compensation, or medical insurance, pensions and retirement benefits paid directly to you and not included in your 1099. As mentioned earlier, the term 'health care,' when referring to an individual who is not employed (for example, you do not receive the health care provided by your employer), is generally only considered to be included in a 1099 and not in this line. Therefore, if you receive medical or dental treatment (including prescriptions) on a business trip, you will only have to report that portion of the treatment paid from your business account. The next 10 lines for a 1099-MISC form are used to indicate any income received or services rendered to a customer for a cost that exceeds 25.00. These include expenses you might incur while taking care of: a customer (such as cleaning or laundry), a family member (such as babysitting), or an agent. The 'agent' is defined as anyone who is involved solely in the customer service of another person (i.e., your business) who has entered into a contract with you that states the 'agents' will not report any payment under 1099-MISC if that other person provides your services for a profit. If your business only earns a profit with your customer service and has no more than one agent, you do not need to include the income from the agent and instead report it on the first line when calculating your income. A line is next included to identify any other taxable income in excess of 25 which you include on your 1099 in addition to any income you received from customer services or in excess of 25 that you are not required to report on your 1099. These taxable income does not include your investment income or any interest income. Interest income includes interest for loans to the business and interest payments made to the business during the calendar year. Interest for services rendered is reported under line 5 of Form 1099-INT. The interest to be reported is determined by applying the interest rate and term to the cost of the services rendered.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1099 Int San Diego California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1099 Int San Diego California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1099 Int San Diego California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1099 Int San Diego California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.