Award-winning PDF software

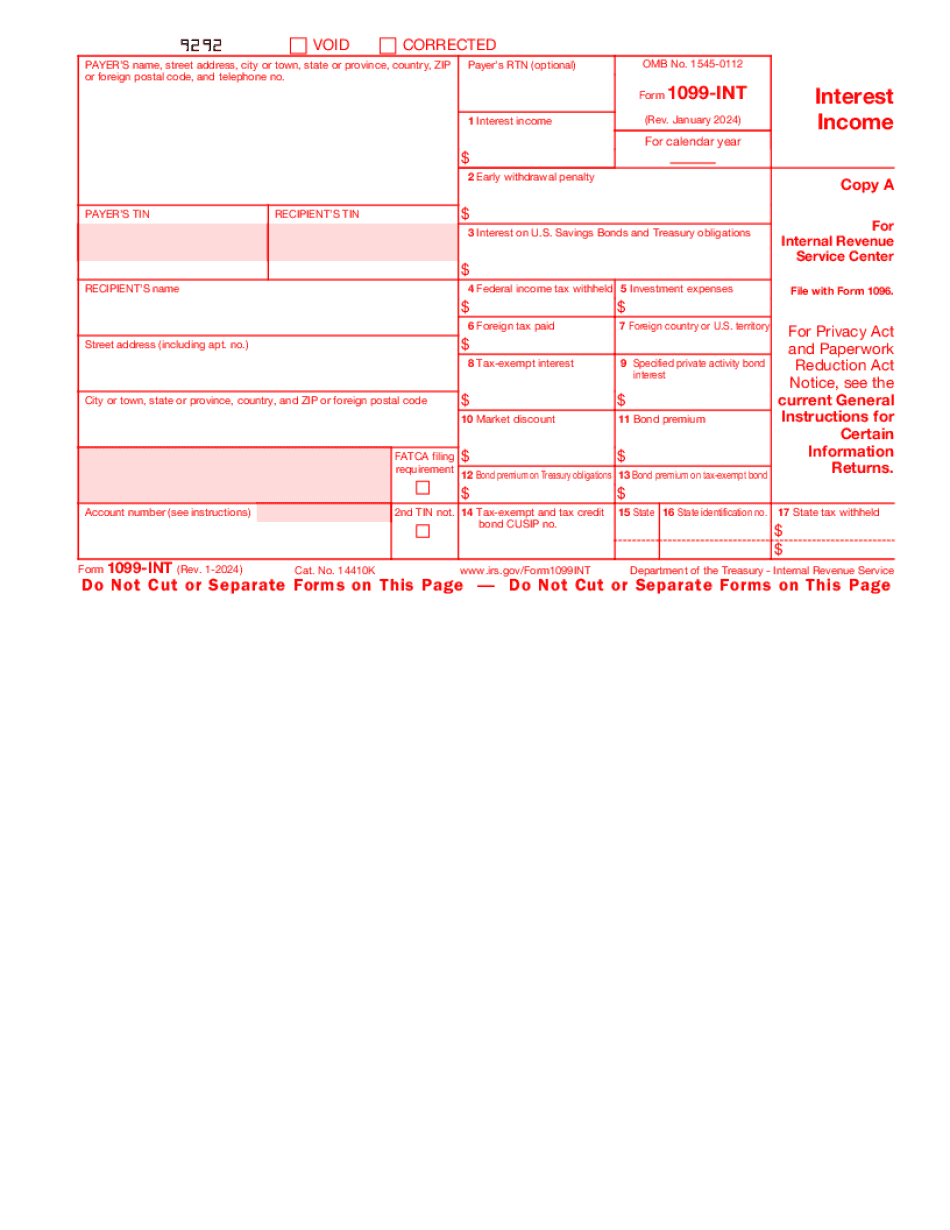

Garden Grove California online Form 1099 Int: What You Should Know

May 15, 2025 — City of Orange. . May 15, 2025 — Orange County is now operating its own website. Click here. . Orange County will no longer be the location of any City of Garden Grove websites after May 15, 2015. May 16, 2025 — City of Garden Grove to discontinue service as customer service agent for. May 15, 2025 — City of Garden Grove. May 15, 2015. All online service will be offered by. This includes City of Garden Grove tax payment, e-filing and the ability to file online. The website has all the City of Garden Grove forms and is available to anyone who resides the city. May 31, 2025 — City of Garden Grove. The City is continuing to use a third party billing software provider (i.e. Pay-By-Phone) to pay for tax. This provider charges the City for payment processing and related services. The City is seeking to find a billing software provider that is better and more cost-effective. The City does not expect this transition to result in any significant shortfalls. It will be important for the city to monitor performance, and make changes if necessary, to avoid further significant shortfalls. To contact the tax collection department, please call. May 25, 2025 — City of Garden Grove. The City is currently processing an additional 861 non-city payroll tax returns each week, and has approximately 1088 employees. June 15, 2025 — City of Orange. The City is experiencing slow payments to employees, which have negatively impacted customer service. August 1, 2025 — City of Orange. The City of Orange may implement its own payment method and payment system. October 25, 2025 — City of Garden Grove. The City is currently transitioning to Pay-By-Mail. The City is using a third-party vendor to handle payment processing. December 3, 2025 — City of Garden Grove. The City will be using a third-party vendor to implement a payment system. December 21, 2025 — City of Garden Grove, Orange County. City of Garden Grove pays into the County, with an estimated total of more than 4 million for the 2025 fiscal year. Payroll taxes collected for the City are currently being reimbursed to the City, by OC Taxpayers. The City is continuing to work out details of a long-term partnership that would involve a direct payment of OC Taxpayers' payroll taxes to the City of Garden Grove.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Garden Grove California online Form 1099 Int, keep away from glitches and furnish it inside a timely method:

How to complete a Garden Grove California online Form 1099 Int?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Garden Grove California online Form 1099 Int aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Garden Grove California online Form 1099 Int from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.