Award-winning PDF software

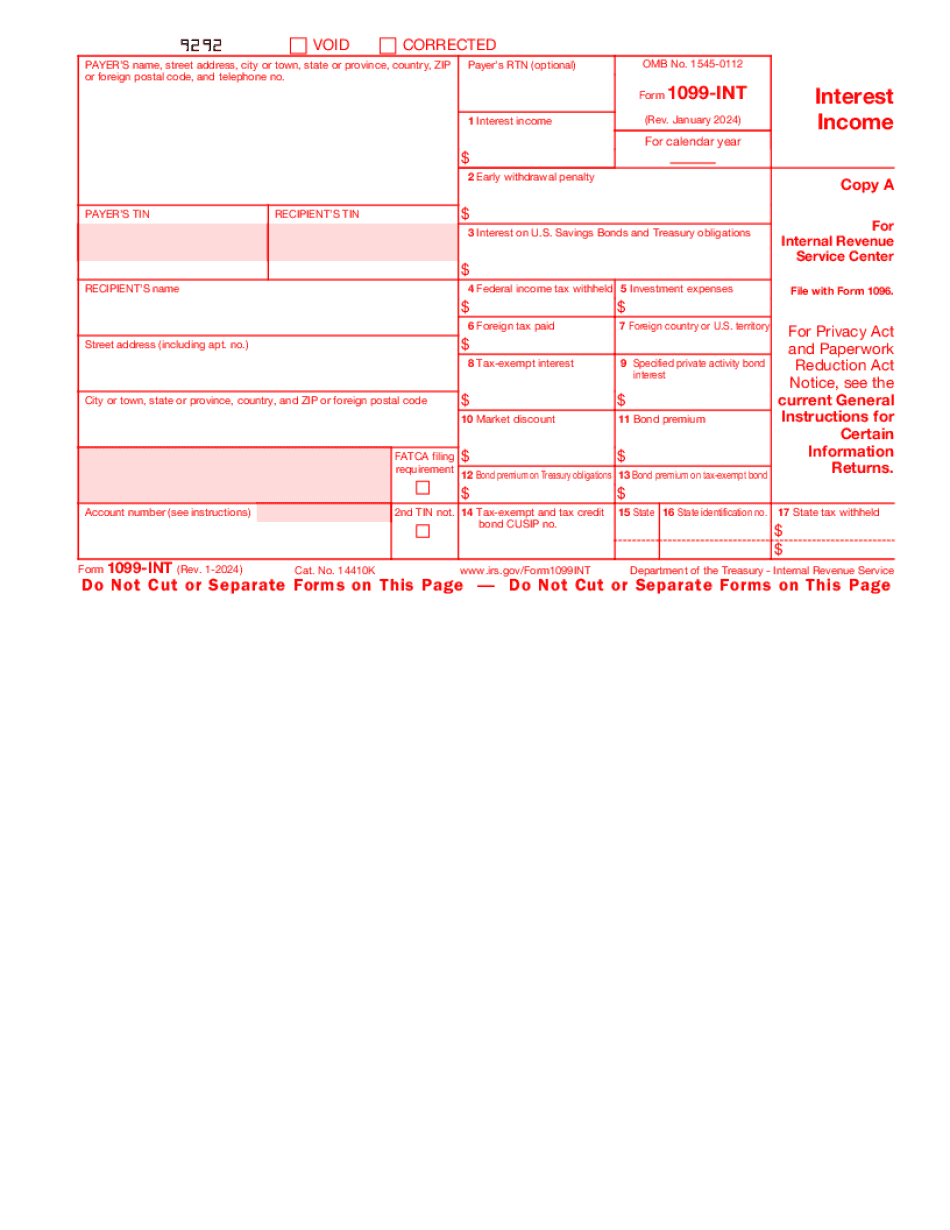

Form 1099 Int Lakewood Colorado: What You Should Know

Members who make less than 10,000 and whose interest earned was 10 or more are not eligible for a form 1099-INT, which may be used for filing a claim for refund if you file Form 1040, 1040A, 1040P, or 1040EZ. Form 1099-INT is sent to all members upon their request. Any unused 1099-INT must be reported to the IRS. As an alternative to 1099-INT, members who must file Form W-2G with respect to their wages may be eligible to claim a Form W-2G interest adjustment. Click here (PDF) to download the W-2G Interest Adjustment Guide. This is a form where the IRS is trying to find out if you really received the full amount they are looking for. In fact, the IRS will even ask you if you received a Form 1098-G and/or 1099-MISC (for example, if you received a statement indicating that there was no tax withheld in error). The IRS is legally required to issue 1099s or other government forms of financial information when it receives an electronic payment from an individual or a business entity (such as a loan) for a purchase from the IRS using the Electronic Filing System (EFS). The IRS recognizes that you may be using EFS at the time EFS receives and deposits your payment. EFS will issue a written request to the Electronic Funds Transfer (EFT) processor. The EFT processor will electronically generate two documents: a check, money order or direct deposit slip (the documents are usually called 1099-K and 1099-MISC). In general, the IRS sends an electronic check to the recipient address on file with the Electronic Funds Transfer (EFS) processor for deposit using your EFS login ID when you make a payment (the payment type is automatically selected for you). The Electronic Fund Transfer (EFT) processor is the money transmitter institution (MTV) that is responsible for processing and transferring the payment. You or the EFT processor will be responsible for paying the transaction. When you receive a 1099-MISC (Form 1099-K) for payment of a tax you have paid from EFS, you must file either a Form 1040X, 1040EZ or 1040NR.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099 Int Lakewood Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099 Int Lakewood Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099 Int Lakewood Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099 Int Lakewood Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.