Award-winning PDF software

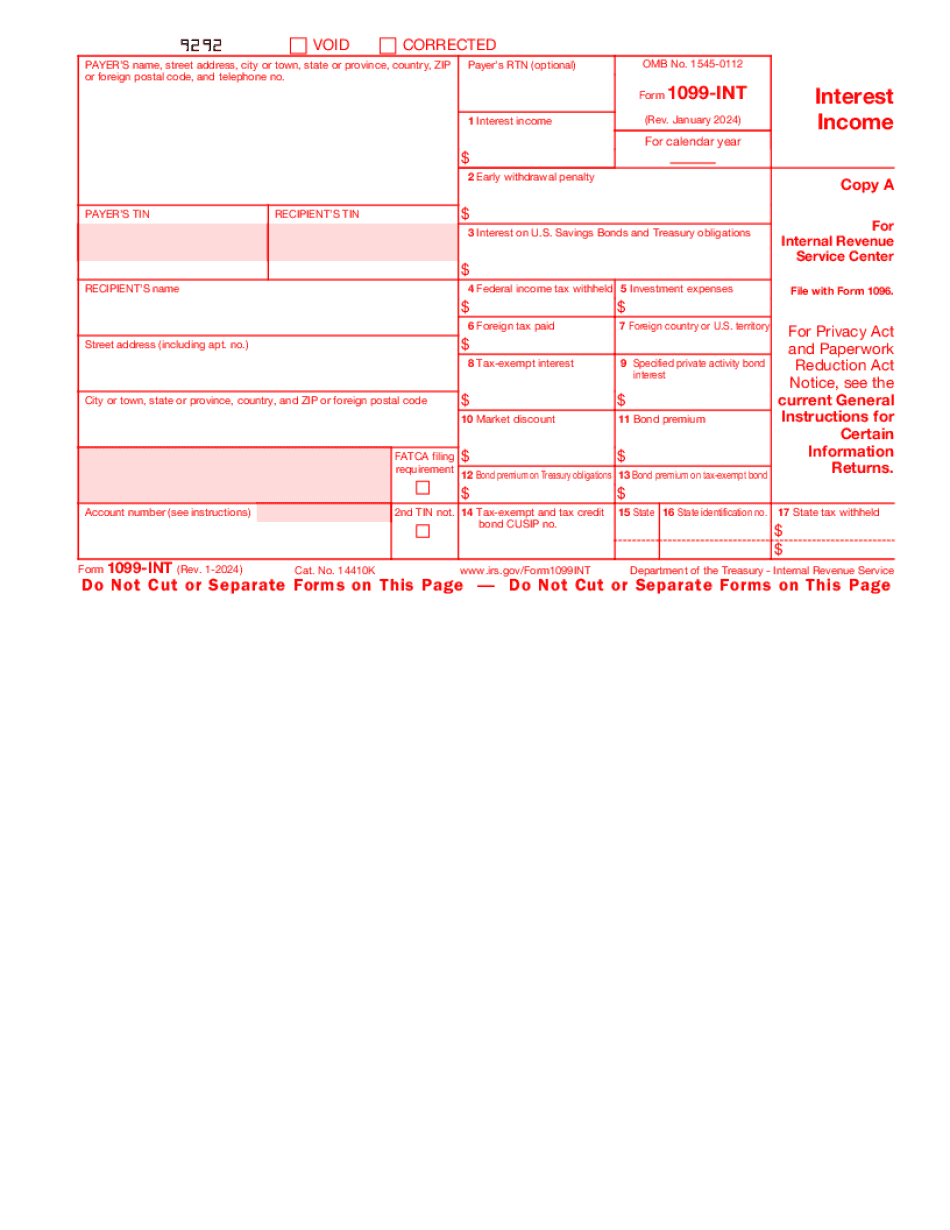

Form 1099 Int Irvine California: What You Should Know

Gov The following applies to 1099-INTs for persons who have filed the Form 1099-INT for the prior calendar year. Any subsequent return to report income from wages, but no prior year 1099-INT must be corrected. You may need to pay additional taxes 1099 Guidance for Recipients — Franchise Tax Board — CA.gov !!! For IRS Taxpayers: 1099 Guidance: For Recipients of 1099-INTs Who Receive Forms From a Third Party — F.T.B. As of January 1, 2021, the Internal Revenue Service (IRS) eliminated its requirement that 1099-MISC and 1099-INT recipients have written confirmation of tax identification number (ITIN). The elimination of the written confirmation requirement was adopted in accordance with Revenue Procedure 2011-33. Form 1099-INT was eliminated as an authorized method of accepting a Form W-2 from a client and filing either Form 8993, or Form 1099-MISC. The Form 1099-INT had been provided to some tax preparers and was considered a “form for personal use.” The elimination of form 1099-INT was made to facilitate efficient processing of the IRS' rapidly growing number of paper returns for the IRS' electronic filing program. “While the elimination of a form has a variety of benefits to taxpayers, our mission is to provide free tax preparation and representation to taxpayers, and to protect taxpayer privacy. The elimination of the Form 1099-INT was in part a response to the IRS's desire to reduce processing burdens and to improve its ability to process and verify electronic forms.” The change in the reporting and filing of Form 1099-INT by taxpayers is not a change in the law. It is a change that the IRS considers “simplifying tax administration.” “Form 1099-INT is not a form for personal use,” said John. “It does not allow the taxpayer to report income as income from personal tax returns. It is not a form for tax planning purposes — you should obtain separate assistance for a Form 1099-INT from an attorney.” “If a taxpayer already filled out a Form W-2 with an ITIN, the Form 1099-Y will still be necessary if the recipient wishes to file a return with the 1099-RET.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099 Int Irvine California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099 Int Irvine California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099 Int Irvine California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099 Int Irvine California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.