Award-winning PDF software

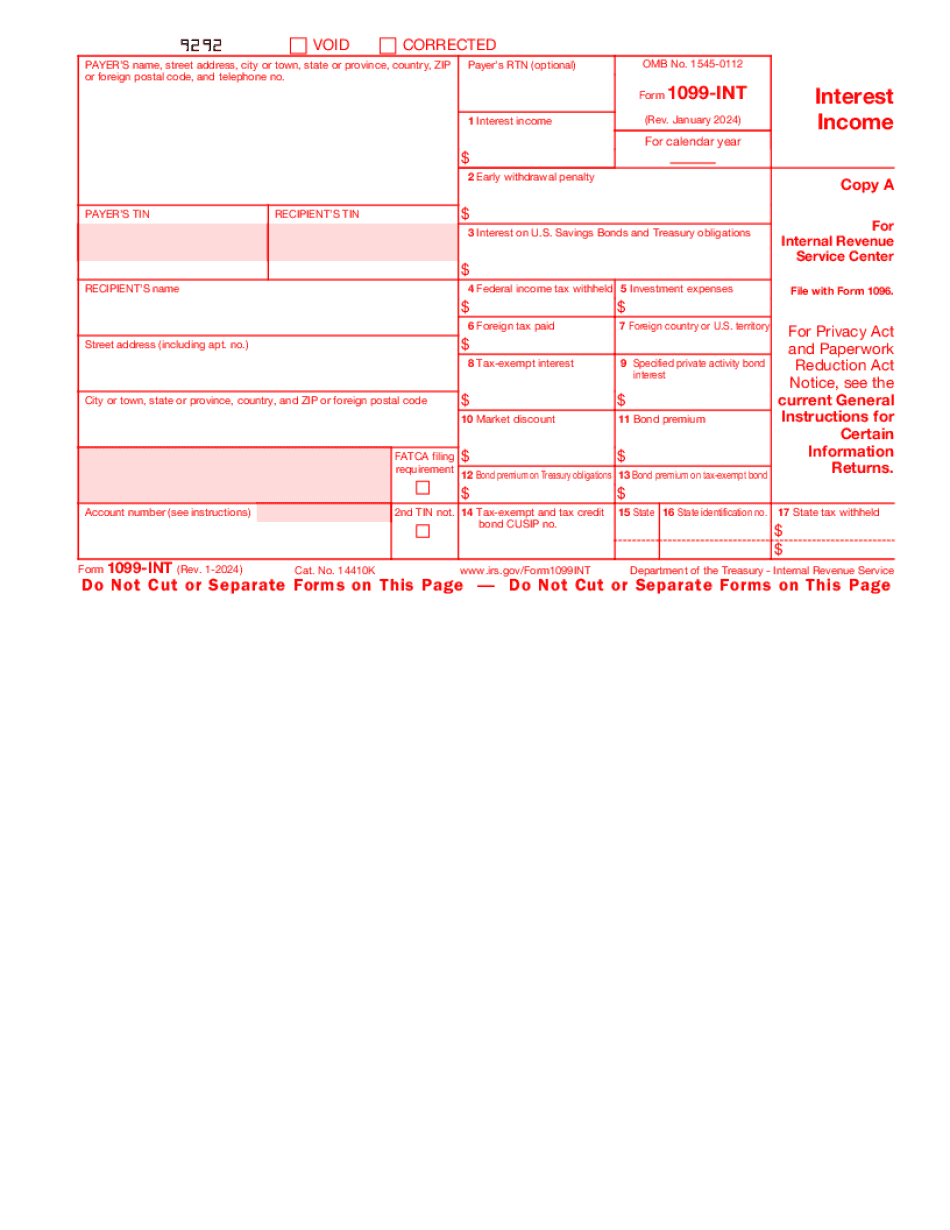

Form 1099 Int for Thornton Colorado: What You Should Know

City of Thornton sales tax. If the purchaser is required to use a sales tax receipt for the tax receipt, fill out and return using the exemption form and the address that is listed on it. When you receive the completed exemption form, save, and save a copy to keep for your records. Item 16 — Instructions: The form you completed on June 30, 2017, is deemed to be an “application and declaration of exemption” for local sales tax purposes. For purposes of this exemption, the form should be: Acknowledgement of City of Thornton Sales Tax Ordinance that the property is exempt from local sales Tax; Written by the purchaser or purchaser's agent and stating the item or items purchased or the amount paid for the instrument or transaction(s); and Certified by the City of Thornton and filed in the Tax Collector's office by the City of Thornton to receive an exemption for the property's use of the ordinance and the purchaser. Payment of any sales tax on items and/or payment of any tax bill on the purchase of the instrument, transaction, tax receipt, exemption or property must be submitted within 15 days after payment is due and before the exemption is issued. A person who fails to do so, notifying the Tax Collector of the failure, is subject to a civil penalty of up to one thousand dollars per offense. Taxpayers may provide the sales tax exemption and/or any of the information listed in Item 18 to anyone they notify that has a claim for refund. Please send all requests that meet the above and the application form above to the following address: City of Thornton Sales Tax Exemption P. O. Box 1518 Thornton, CO 80903 Payment of Thornton sales tax will occur on or just before the due date, at the time of the payment (see invoice for specific sales tax rates). The City is not liable for late payment of any tax, collection fees, or penalties. Sales Tax Notice to Taxpayer. The tax notice is the single document containing all notices and information collected by the City. It is a separate document from the City tax forms, and you should obtain that document before filing a complaint with the Division. The City receives several copies of the sales tax notice when it issues tax notices.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1099 Int for Thornton Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1099 Int for Thornton Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1099 Int for Thornton Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1099 Int for Thornton Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.