Award-winning PDF software

About form 1099-int, interest income | internal revenue service

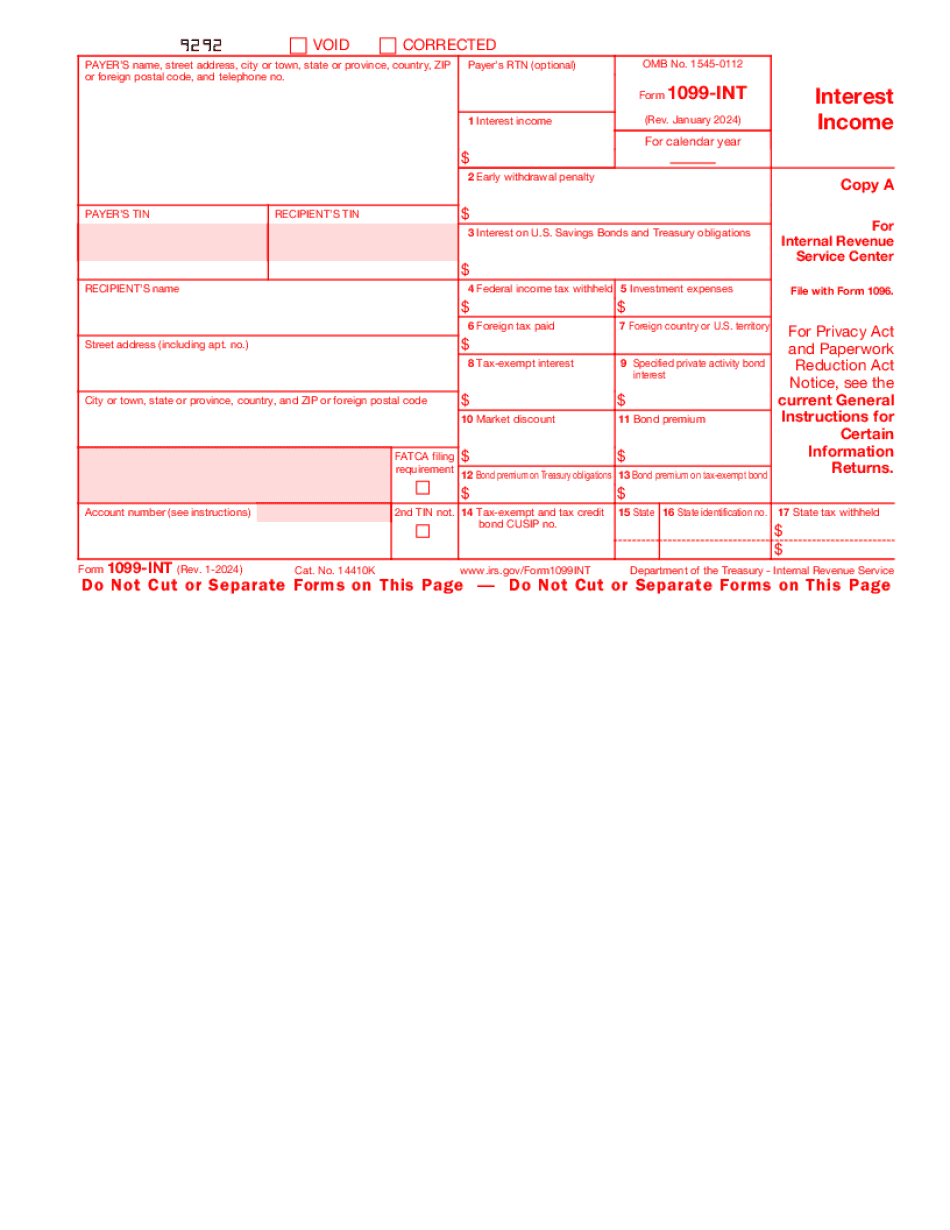

Form 1099-INT is for income reported from various sources, including earnings from noncapital sources and interest. Other Forms 1099 are taxable income, or business income and income from partnerships, in which the business earns only income. Other forms of unearned income, such as those from sources other than a business can also be included in your Form 1099-INT. Form 1099-INT includes an entry to show interest earned. There is a penalty for not including all the information required, which is an adjustment to the amount which is subject to the tax but will not alter a refund or credit. This penalty is set forth in 29 §§ However, the penalty will never be assessed if you are able to provide the required information within one year after the year in which you made your return and filed the return. If you cannot provide all the information, it will reflect.

form 1099-int (rev. january ) - internal revenue service

Washington.

Form 1099-int: interest income definition - investopedia

Companies. . . Are . . . Registered to report, in box 2, their account balances to the Securities and Exchange Commission. . . . A tax withholding tax is not required by statute or rules but may be required by the taxpayer. Banks, brokerages, and other financial institutions. . . Receive the tax from their depositors to distribute directly to their users. . . . The IRS has determined that a financial institution's obligation to report returns of interest income derived from a customer on a 1099-INT form is a non-reporting obligation. . . . It is not considered a reporting obligation for a financial institution merely to report, in box 2, returns of interest income. . . . [T)he tax may not be collected if either the individual has previously reported to the Internal Revenue Service on the form a tax withholding tax of 25 or.

What is form 1099-int?

Org account the amount must have been 10 plus 1/2% interest, rounded to 11/2% unless otherwise written out. If you earned less than 10 in interest from a bank, brokerage or .org account you must have earned less than 10 in interest before taxes (as the rule states) in order to qualify for the 1099. An amount of interest earned is not deductible if you are an employee. If it wasn't earned you can't get another 1099 form from the bank or entity. There are certain rules for paying interest for a bank, such as making the payment from the bank's account. For more details, see the 11/2% table below. If you earned the 1099 from your IRA or Roth IRA you will get a 1099-INT form. The IRS publishes it annually, starting in 2011. The amount will be rounded down to the nearest whole dollar. If you don't have an IRA or.

Filing tax form 1099-int: interest income - turbotax

The other 1099 you received may still have income tax withheld as a penalty. You need to determine if you need to pay income tax on the interest earned and whether the amount of interest you receive is sufficient to satisfy the tax. Here is the table: 1 — interest is not taxable 2 — interest is taxable 3 — income tax on both 1 and 2 is not required 4 — income tax on the first 1099 is still required 5 — income tax on the second 1099 isn't required 6 — total income tax of 100 per year must be paid over 9 years 7 — you need to pay income tax from 1 to 9 years If any of these cases apply, you must pay tax on interest earned. For more information, you can see How to report interest income on your 1099-INT or Tax Topic: How To Report Interest Earned.