Music section one. You will hear a conversation between two friends called George and Nina about a summer music festival. First, you have some time to look at questions 1 & 2. You will see that there is an example that has been done for you. On this occasion only, the conversation relating to this will be played first. "Hi George, glad you're back. Loads of people have phoned you. Really, I felt just like your secretary. Sorry, I went into the library this afternoon to have a look at a newspaper and I came across something really interesting. What, a book? No, a brochure from a summer festival. Mainly Spanish music. Look, I've got it here." George says that he found a brochure from a festival, so B has been circled as the answer. Now, we shall begin. You should answer the questions as you listen because you will not hear the recording a second time. Listen carefully and answer questions 1 & 2. "Hi George, glad you're back. Loads of people have phoned you. Really, I felt just like your secretary. Sorry, I went into the library this afternoon to have a look at a newspaper and I came across something really interesting. What, a book? No, a brochure from a summer festival. Mainly Spanish music. Look, I've got it here. Spanish music, I really love the guitar. Let's have a look. So, what's this group, Guitar Eenie? They're really good. They had a video with all the highlights of the festival. That a stand in the lobby to the library, so I heard them. They play fantastic instruments, drums and flutes, and all kinds of guitars. I've never heard anything like it before. Sounds great. Ok, shall we go then? Spoil ourselves, yes let's. The only problem...

Award-winning PDF software

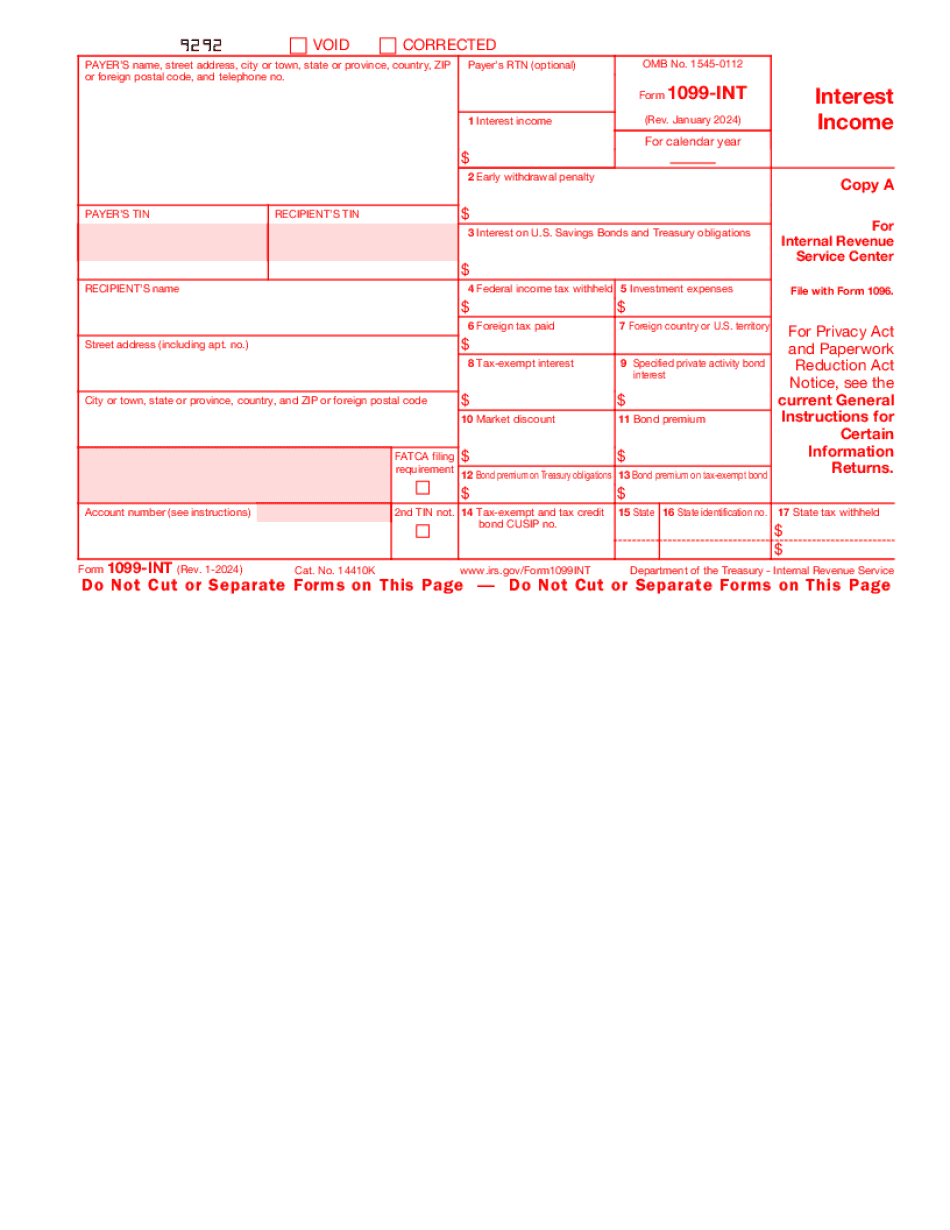

2018 1099-int Form: What You Should Know

Oct 28, 2025 — If you claim the standard deduction on Form 1040, and you don't itemize, you can exclude the following amounts from income for exemption purposes: 1026 payments to a qualified state or local government for storm evacuation relief services. 1040-X and 1040-SS forms. You can exclude the following amounts from your taxable income for the purpose of applying a reduced tax rate: 1023 payments to the Department of Defense (DoD) for damage from the recent hurricane. 1040-X, 1040-SS, 1040-SS-EZ, 1040-V, 1040-XT, 1040-Y, and any other section (not 1040A) form. The following amounts cannot be excluded from income tax filing obligations: 1023 payments to FEMA for disaster relief. Your withholding allowances on Form 1040, 1040A, 1040EZ, or 1040E. Amounts paid to a qualified State Disaster Relief Program (DSP) office (e.g., Alabama DS SRP, Connecticut DSP). Payments made directly to a DS SRP (e.g., through the U.S. Military or Department of Defense and your DSSRP-accepting employer). Payment of the following amounts received from a qualified DSP (not listed in the preceding list of non-excludable payments), or directly to the DS SRP (a qualified DSP is one authorized by the DS SRP): Payments for emergency medical services (including transportation for the services) when you were physically unable to receive treatment because of a physical or mental health condition. Payments made into the Disaster Relief Fund, or payments made directly to the Disaster Relief Fund, of an item that has been certified as a Federal Emergency Management Program Emergency Assistance Item or a grant-in-aid for disaster relief under title III of the Robert T. Stafford Disaster Relief and Emergency Assistance Act: 1040-SS form, or 1040-SS-EZ, 1026 payments to qualified teachers. This is the amount withheld from the employee's paycheck to cover qualified expenses.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099 Int, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099 Int online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099 Int by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099 Int from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 1099-int