Hi, this is James Barn for the ST OBC Mortgage. Today, we'll be talking about the Uniform Residential Loan Application, commonly known as the 1003. I'd like to go through parts of the application that are not obvious and tell you some of the underwriting guidelines that go along with it. So, make sure you understand what we're going to be asking for and why. Then, when you get to do the loan application online, you will have a much clearer understanding of what we need from you. Now, let's skip through the first part. Most of the information is pretty obvious, such as the loan amount, interest rate, and other basic details. Now, let's discuss some things that might not be so obvious. For instance, the title of the property. Typically, you want to use your first name, middle initial, last name, and your spouse's or partner's name. If you have a non-purchasing spouse, like a father or mother who will not live in the property, their information needs to be added as well. Another important aspect is how the title will be held. There are several options: sole ownership (if you're a single person and it's your property), tenants in common (for siblings or partners who each own a share), joint tenancy with rights of survivorship (where the property automatically transfers to your partner upon your death), and community property (in Texas, where property automatically transfers to your spouse unless otherwise specified in a separate document). Moving on, let's talk about the borrower section. Obviously, you need to provide your name, address, and social security number. This information is pretty straightforward. However, there's one section that people often overlook: if you've been divorced and have children, we need to know their ages and how many you have. This is important because...

Award-winning PDF software

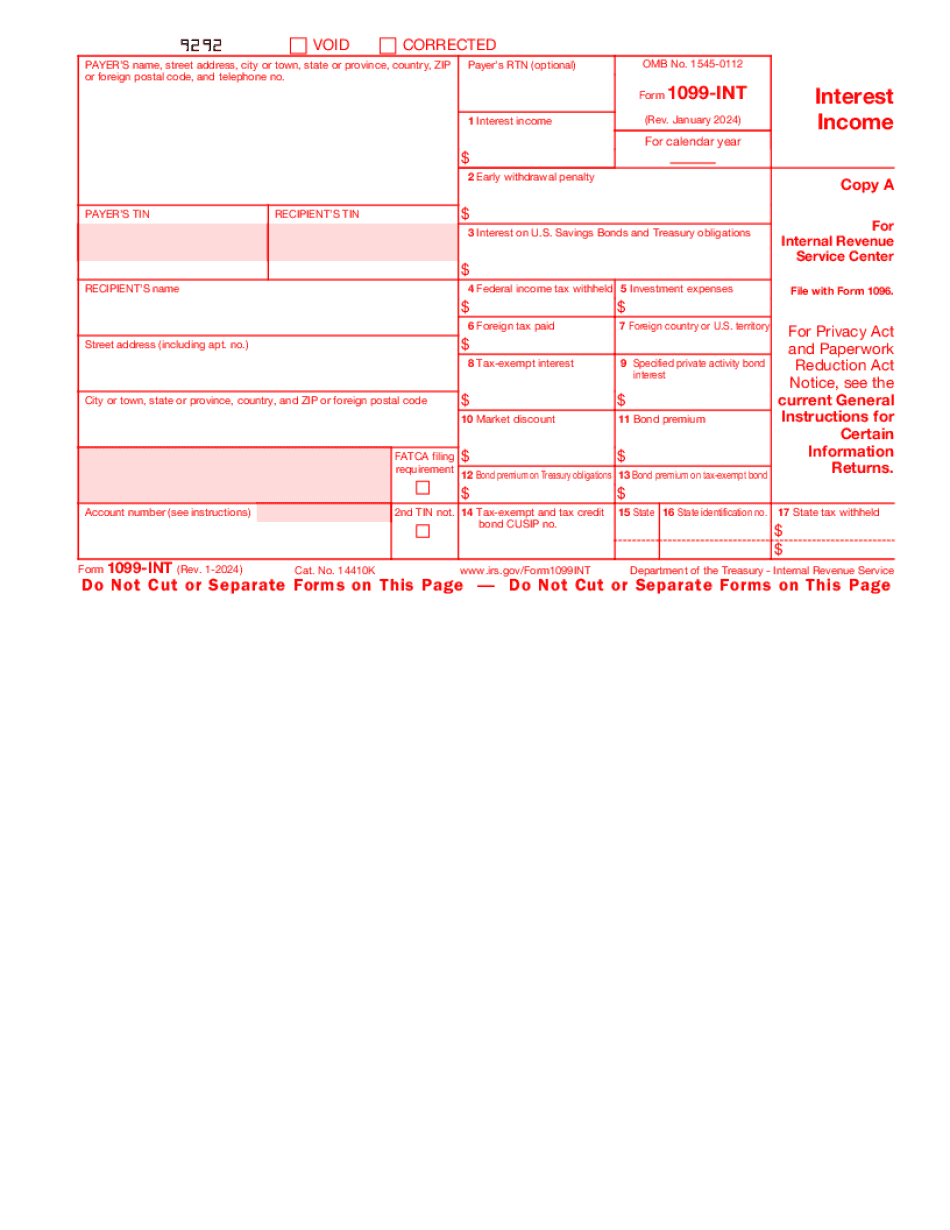

Mortgage 1099-int Form: What You Should Know

What If You Earn More Than 10.00? — Bank of America (Info) To earn interest, you must pay the bank back at least the minimum interest rate on your mortgage loan. About Form 1098, Mortgage Interest Statement — Bank of America (Info) About Form 1099-INT, Interest Income — Bank of America (Info) Form 1099-INT is used to report interest income. About Publication 938, Real Estate Mortgage Investment Conduits (Relics) Reporting Information. Form W-2, Wage and Tax Statement — IRS (Info) May 31, 2025 — This is how you would earn interest from your lender on your mortgage loan. You should also receive the mortgage interest paid statement which would How to Earn Interest on Your Mortgage Loan — Fannie Mae (Info) How much interest would you earn on a mortgage loan? I don't earn much interest because we are in a low-cost area and don't qualify for a mortgage loan. Our mortgage payment is 350/month, and we only have 5,800 in home purchases. Here are some things to I did earn money from our home purchase. I could have sold the house for 350 per year, but I kept it because it has my mom. Our home is worth 230,000, and I paid 22,000 in mortgage upfront, so it will give us 1 year for her to pay the debt off. With my mother's help, it will last our family for 12 years. How Do You Earn Interest? There are two ways to do this, and you need to know how to do each one. Here's the Form 1099-INT is used to report interest income. About Publication 938, Real Estate Mortgage Investment Conduits (Relics) Reporting Information. Form W-2, Wage and Tax Statement — IRS (Info) May 31, 2025 — This is how you would earn interest from your lender on your mortgage loan.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099 Int, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099 Int online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099 Int by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099 Int from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Mortgage 1099-int